Newsletter 03 - July

2024

Bula Vinaka Fellow Fiji Business Network NZ members and supporters.

Welcome to our 3rd newsletter for the year, where we will share news, business wisdom, and economic updates.

Our Annual General Meeting (AGM) is being held on 22 August 2024 at 6.30pm. This will be followed by our Mid-Year Networking Event and Dinner, at the Remuera Club, Auckland.

At a recent Fiji Girmit community event, which was well organised and attended, there was a lot of traction for our Fiji Business Network and why this should help unite us in our common cause of “economic success”.

The good news is we now have 68 paid members and are making progress towards our goal of uniting our fellow Fijians in Business.

We would like your feedback on what else you would like us to share, so we can enhance our membership experience. Please feel free to email feedback to Sonali Patel, sonali.patel@hsaglobal.net.

Vinaka

The Executive Team

Events and Activities for 2024

1. Networking events

- 7:30pm Thursday 22nd August 2024 : Remuera Club, Auckland

- 20 November 2024 : to be advised

2. Virtual Talanoa Session

(calendar invite will be sent to lock in these dates)

- 8.00pm – First Tuesday

of every month

- Question and Answers (Q&A) sessions

- Updates, success stories

- Keeping connected

3. Annual General Meeting

- 6:30pm 22nd August 2024

- Executive Elections

- Increasing membership base

- Target to two hundred paid members by end of the year

- Special Industry groups

to be formed as membership increases. Eg. Building and Trade, Finance, Retail,

etc.

4. Regular Business

updates and opportunities

- via our Newsletter

We need your help to achieve our Membership

As an organisation primarily focused on connecting and helping our fellow Fijians thrive New Zealand’s commercial sectors.

We are all about spreading the good word.

It has taken a good deal of work and planning to this point, and we are excited that 2024 will be a year of progress.

We are keeping it simple, with membership rates starting at $25.00 per year. The membership fee runs through to 31 March 2025.

Head over to our website, spread the good word, and encourage at least 3 new parties to join our network. It is quite simple to join.

We are confident that once we have reached our goal of 200 members, we will be better placed to grow our visibility at Government and institutional levels.

This undoubtedly will have

a multiplier effect on our members, our organisation, and the overall success

of Fijian businesses in New Zealand

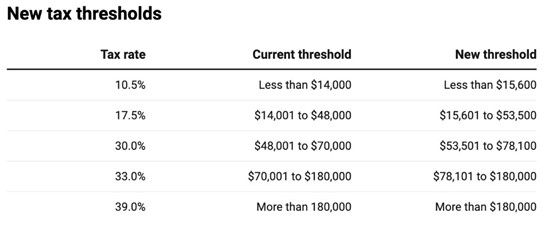

New Tax Thresholds in 2024 NZ Budget

The New Zealand government unveiled its 2024 Budget with a core election promise delivered regarding tax relief of $2.57 billion through bracket adjustments.

With an adjustment to income brackets, tax rates remain the same but the thresholds are raised.

The Budget stated that 1.9 million households would benefit from the overall relief package by an average of $30 a week. Households with children would benefit by $39 a week on average.

The Independent Earner Tax Credit is being expanded, with the upper limit for eligibility rising from an income of $48,000 to $70,000, with amounts reducing from $66,000+ instead of $44,000+.

A minimum wage worker could expect about $12.50 a week, while super-annuitants would take home just $4.50 a week.

The in-work tax credit will also go up by up to $25 a week from 31 July 2024. The relief package also includes a childcare payment for low-and-middle-income households as already announced

Other key government expenditure items in the budget include :

- $155 million on Independent Earner Tax Credit eligibility changes in line with National's election campaign

- $182 million on In-Work Working For Families Tax credit by $25 a week, in line with National's election campaign

- $729 million on restoring interest deductibility for residential rental property

- $45 million on adjusting

the Brightline Test on Property investments

Budgeting for success: the importance of good financial management

When you’re operating and managing a small business, you have a finite pot of cash to work with. Because of this, it’s incredibly important to manage your cash well and to have clear budgets and spending limits for every area of your business operations.

Let’s take a look at why budgeting is such a vital part of your financial management, and what you can do to keep your company on budget and in a positive cashflow position.

4 ways to stay in control of your business budgeting

It’s impossible to run a successful business without having a tight rein over your expenditure.

Sales may be bringing in healthy revenues, but the income and profits you’re generating can quickly be eaten up if you’re overspending on operational costs, marketing campaigns, staff payroll or investments in new hardware and software.

We’ve highlighted four ways to put good, solid budgeting at the heart of your financial process:

1. Embrace the power of budgeting

A well-crafted business budget gives you the foundations to become a financially healthy and successful business that’s in control of its spending.

You don’t have to use a complicated budgeting app; a simple breakdown of income and expenses in an Excel spreadsheet can be a great starting point.

To get started :

- Track your projected sales, so you understand your future revenue numbers and have a solid projection for your income over the course of the year, or budget period.

- Calculate your costs, including fixed costs like rent and utilities, and variable costs like inventory and marketing. This gives you an understanding of your total expenditure. Don't forget to factor in business taxes and contingency funds to cover emergencies.

- Set clear budgets for the coming period’s spending, based on the total income you’ve predicted and the total fixed and variable costs you’ve estimated. Always leave some wriggle room to account for inflation and changing costs.

Regularly review your budget, so the document is always evolving. Reviewing and updating your budget helps you stay on track, identify areas for cost-cutting, and make informed decisions about resource allocation. Remember, a budget is a living document, so adapt it as your business evolves.

2. Track your budgets, income and spending

Setting the budget isn’t the end of the process. It’s important to track all income and expenses and to update your budget in line with the current health of your business finances.

Using the latest cloud accounting software can work wonders. These cloud tools help you record your incoming and outgoing transactions in real time, so you can work with the most up-to-date numbers and financial data when reviewing and reworking your budget.

To improve your tracking :

- Use codes to categorise your expenses – the Chart of Accounts in your accounting software makes it easy to categorise each expense as it’s incurred. It’s then easy as ABC to review your financial reports and to analyse your spending patterns.

- Review your spending – check your spending against each code and see where budgets are on track, or where there’s overspending that’s threatening your budget. Are there subscriptions you can cancel? Or could you renegotiat

Add Row

Add Row  Add

Add

Write A Comment